The Dos and Don'ts When Working with a Mortgage Broker

Choosing the right mortgage broker plays a major role in shaping the home-buying experience. Mortgage brokers provide an intermediary service for people seeking home loans to assist them with purchasing appropriate mortgages, based on their financial circumstances . Using a broker in mortgage-related activities demands thorough evaluation. Knowledge of proper and improper mortgage broker procedures will lead you to superior mortgage deals and prevent typical mistakes. The guide provides the right advice for selecting the right broker while explaining crucial working practices and strategies for obtaining the best broker benefits.

What to Look for When Choosing a Mortgage Broker

Getting a competitive mortgage requires selecting the proper mortgage broker. The expertise level of a broker together with their relevant qualifications determine their reliability in the industry. Make sure to check their qualifications together with licensing and how long they have been working as it shows their comprehension of mortgage products and lender standards.

Reviews and reputation become important tools to gain essential information. Selection of trustworthy brokers becomes easier with reviews from online platforms and evaluations obtained from family members and friends. Reliability in a broker depends heavily on transparency because dependable brokers disclose all fees together with commission details along with their lender partnerships. Winning deals from multiple lenders becomes possible for borrowers who work with brokers who maintain strong connections with many lenders. Superior customer service along with ethical behavior and market experience constitutes the essential elements. A broker must demonstrate promptness and explain everything clearly to help clients proceed successfully through their mortgage applications.

The Key Dos When Working with a Mortgage Broker

A successful relationship with a mortgage broker requires both active involvement and well-informed decisions. Doing some diligence on fundamental mortgage concepts along with interest rates and loan varieties before broker meetings helps enhance communication during meetings while making better sense of their recommendations. Comparing offers is equally important. Your trust in the broker should not stop you from looking at multiple loan options since this process helps you properly understand interest rates fees and terms before finalizing your decision. Natural honesty in your financial condition stands vital because accurate debt and payment and history facts let the broker secure suitable mortgage terms for you.

Financial information secrecy results in mortgage loan denial as well as additional expenses that appear afterward. In addition, truly understanding the costs associated with broker service plays a crucial role in home buying. Also, reading and checking all documents completely must be your final step before signing them. Reading every statement inside mortgage contracts along with loan agreements will allow you to detect unfavourable terms and maintain clear agreements.

“ Engaging with your mortgage broker to best understand your questions and needs allows you to obtain maximum value from the mortgage process. A knowledgeable borrower holds tremendous financial power in the market.”

— Victoria Ishai , Commercial Mortgage Agent Level 2 at Clover Mortgage

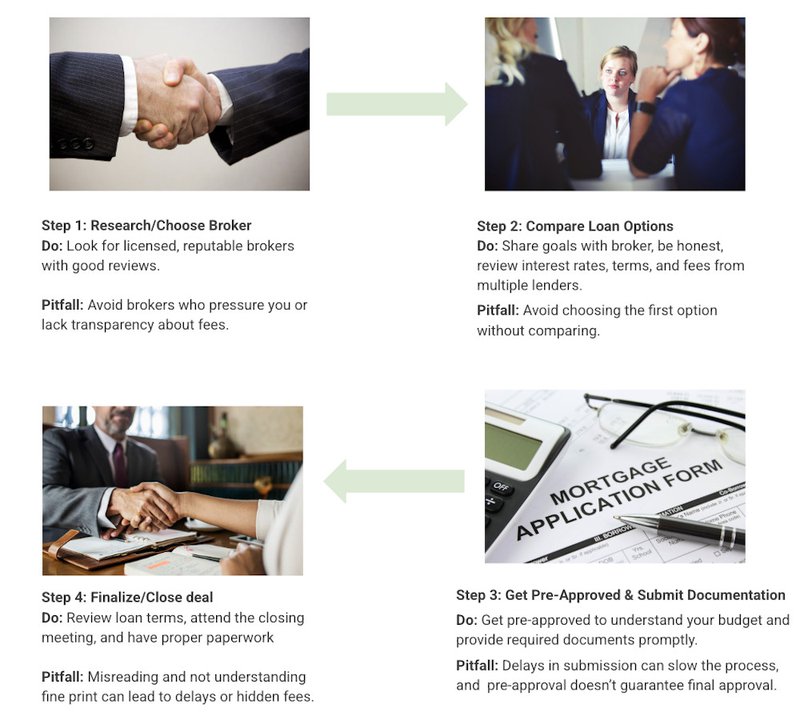

Steps in Working With a Mortgage Broker

Common Mistakes to Avoid When Working with a Mortgage Broker

Most homebuyers encounter problems because of their interactions with brokers. The main mistake people make when working with brokers is believing they will seek out the best possible deal automatically. Homebuyers need to research their options independently because brokers work with limited lenders and fail to show all possible choices. The premature selection of a decision stands as another major mistake. Reviewing mortgage options thoroughly before the agreement will help avoid bad terms due to the extended period of commitment.

The failure to account for closing costs broker fees and lender charges together with interest rates will result in financial pressure. Checking the credentials of brokers remains important because collaborating with unlicensed brokers introduces both novice-related risks and unethical behavior possibilities. Negotiation is an opportunity that could aid the homeowner if they decide to pursue it. Brokers may have limited room to negotiate between lenders with rates and fees because it pays to inquire when their offer could be better.

Comparison: Mortgage Broker vs. Direct Lender

| Feature | Mortgage Broker | Direct Lender |

|---|---|---|

| Loan Operations | Multiple lenders and loan types | Limited to the lender’s products |

| Interest Rates | Competitive, but may include broker fees | Direct, may offer special deals |

| Application Process | Simplifies and guides you through different lenders | You handle the process directly with one lender |

| Fees | Broker fees may apply | No broker fees, but lender fees exist |

| Negotiation | Can negotiate on your behalf | Limited negotiation flexibility |

How a Mortgage Broker Can Help You Secure the Best Mortgage Rate

Mortgage brokers serve their clients through services that exceed the basic lender introduction. The access of brokers extends to a wide variety of lenders including banks credit unions and private lenders this gives them the power to seek out favorable rates. Mortgage brokers derive value by applying their negotiating abilities to secure both reduced mortgage interest rates and lowered costs.

Through their experience, brokers assist you in adjusting your credit records and financial state for better qualification conditions when applying for mortgage deals. The analysis of specific financial needs results in broker-provided mortgage solutions that match the individual requirements. The advantages that mortgage brokers provide allow their borrowers to get improved mortgage terms and interest rates which standard borrowers cannot negotiate themselves.

Your Comprehensive Checklist: Working with a Mortgage Broker

Things to Do:

- Review different mortgage brokers to evaluate their background experience and inspection results from customers.

- Your financial reality should be disclosed completely to brokers for the provision of accurate mortgage selection.

- When applying for mortgages obtain at least three loan options which allow you to assess interest rates and fees while reviewing the terms.

- Research the process of mortgage broker payments to verify all their fees.

- Always examine all documents with great attention before signing any agreement.

- Seek clarification through questions from your mortgage provider when you need to understand their procedures better.

- Marketers should evaluate loan conditions and brokerage expenses for improvement.

Things to Avoid:

You need to verify that your broker showed you the optimal deal because he did not evaluate other possibilities available in the market.

- The act of making a quick decision prevents checking all loan terms and conditions carefully.

- Failed recognition of the expenses involved in closing costs as well as broker fees.

- Using an unlicensed or failed to receive positive reviews from mortgage broker services.

- People who do not disclose crucial financial data that affects mortgage approval decisions create obstacles to obtaining funds.

Conclusion

Mortgage brokers serve as helpful professionals for finding competitive mortgages although clients need to act proactively. The combination of proper research into available options and questioning and mistake avoidance will lead to a smooth mortgage process. The knowledge of the advantages and risks will guide you toward selecting a broker or lender with assurance.

Contact Clover Mortgage Brokers today to find the best mortgage broker for your financial goals.

FAQ

What should I look for when choosing a mortgage broker?

Choose a mortgage broker who shows experience along with a great reputation has transparent fees for services provides access to multiple lenders and offers superior customer service.

What are the key dos when working with a mortgage broker?

It is essential to research mortgage options while comparing different offers and disclosing your financial details to understand all fees and examine all papers before you sign them.

What are the common mistakes to avoid when dealing with a mortgage broker?

Do not accept that brokers secure top deals since you need to exercise care and avoid ignoring fees working with unlicensed brokers and failing to negotiate.

How can a mortgage broker help me secure the best mortgage rate?

Mortgage brokers serve to connect borrowers with several lenders and secure better rates while improving personal credit standing and creating suitable financing options for each borrower's financial profile.